Alternative Text Format | Download

Personal Finance Education in American Schools

Personal Finance Education in American Schools

A solid foundation in financial literacy can provide students of all socioeconomic backgrounds with the knowledge and skills they need to:

- Save for college

- Maintain a budget

- Manage debt

- Live on their own

- Make good spending decisions

- Achieve a lifetime of financial well-being

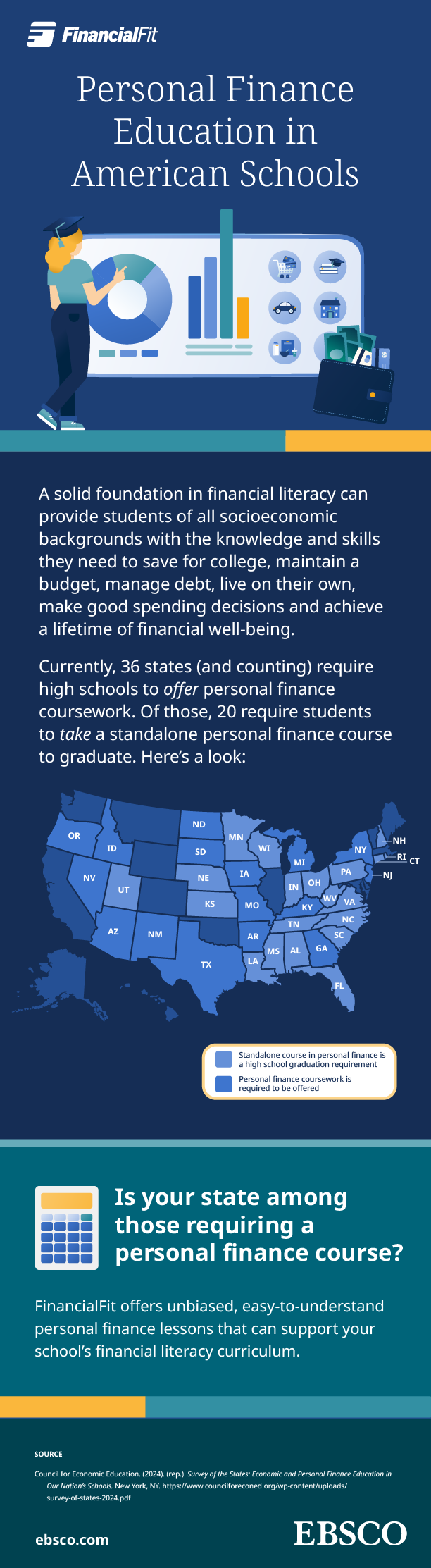

Currently, 35 states (and counting) require high schools to offer personal finance coursework. Of those, 20 require students to take a standalone personal finance course to graduate. Here’s a look:

(U.S. map showing states with different financial literacy education policies)

Is your state among those requiring a personal finance course?

FinancialFit offers unbiased, easy-to-understand personal finance lessons that can support your school’s financial literacy curriculum.

Source

Council for Economic Education. (2024). (repr.). Survey of the States: Economic and Personal Finance Education in Our Nation’s Schools. New York, NY. https://www.councilforeconed.org/wp-content/uploads/survey-of-states-2024.pdf

Learn more about how FinancialFit can support your school's financial literacy curriculum

Learn more about how FinancialFit can support your school's financial literacy curriculum